Over 3 billion people live in 48 developing countries where their governments pay more on interest payments than on either education or health. That is almost half the world’s population. Education and health are key areas of spending if governments want to increase the productivity of their populations, in addition to infrastructure spending. This is a huge opportunity cost that people around the world, including in the developed world, are facing.

https://unctad.org/publication/world-of-debt

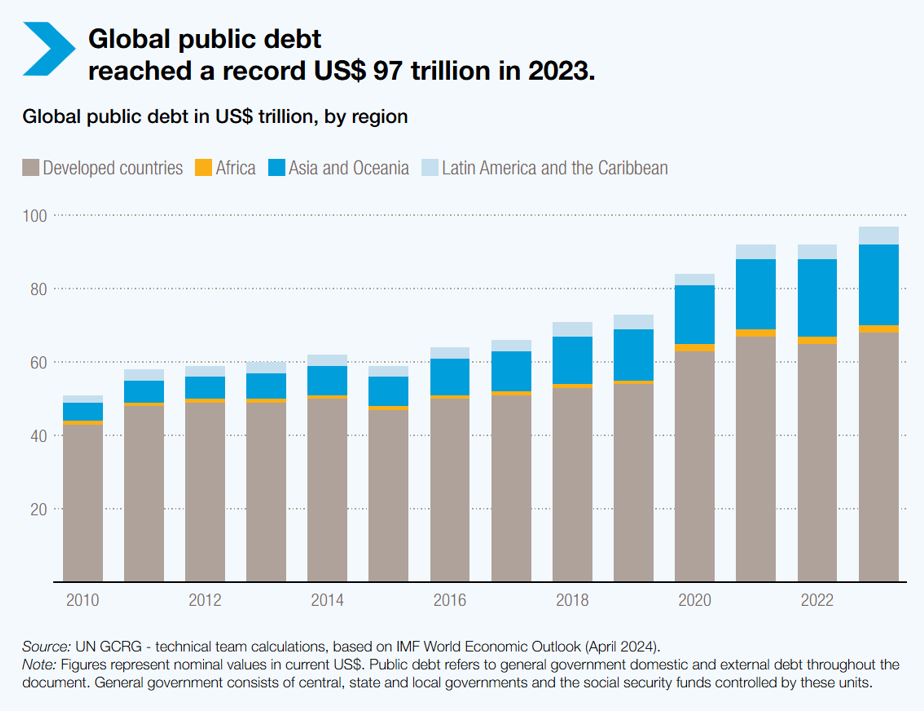

Global debt reached a staggering record of $97 billion in 2023 with 54 countries under debt stress according to the UN. With such large debt levels, many governments are on the edge fiscally. When interest rates rise, it leads to fiscal consolidation, affecting largely the poor and the vulnerable.

The latest Outlook of the World Economic Forum states that almost 40% of chief economists expect defaults to rise in developing economies over the next year. Many governments are unprepared to create a buffer against any future global or local economic downturn. Countries are also facing structural changes to their economies such as increased security needs, energy transition and demographic changes. Higher interest costs due to mounting debt reduce the available fiscal space. At the end of 2023, the total debt (private and public) of developing economies stood at 206% of GDP. Many governments borrow in foreign currency due to current account deficits, leading to higher debt obligations to bilateral lenders and international capital markets. But many governments also borrow locally, which has had a crowding out effect for private sector credit.

What are the options for governments around the world?

Restructuring debt – First, governments should assess the level of their debt sustainability and their ability to reduce it. Restructuring government debt with creditors before debt levels reach highly unsustainable levels would be an advisable move for any government. Developing economies are vulnerable to increased global interest rates as their borrowing costs are much higher than developed nations. A policy interest rate increase by the US Federal Reserve can push many developing countries into unsustainable debt. Also, as the fiscal positions of many developing countries are mostly on the edge, a natural disaster or bad economic policy missteps can also lead to debt becoming unsustainable, leading to debt default.

Restructuring debt after defaulting or just before defaulting makes the economy of that nation highly vulnerable and the restructuring brings greater hardships for the poor. Sri Lanka is an example of a nation whose debt was considered unsustainable as early as 2020, but their government only reached out to the IMF and initiated debt restructuring talks in 2022, when the country’s reserves had fallen to less than $20 million. The lesson for governments is to assess their debt levels early and take the needed steps at readjustment.

Increasing progressive tax collection - Government revenue in developing countries is much lower than compared to developed countries. According to a World Values Survey, people in developing countries generally prefer progressive taxes which reduce income inequality. Indirect taxation tends to be regressive in nature and affects the poor more but can be a powerful revenue raiser. Indirect taxation includes value added taxation, customs duties and service taxes where the poor and the rich may consume roughly the same quantity and therefore pay the same amount of taxes. Increasing direct taxes such as income tax and corporate tax does not necessarily require higher tax rates. In most developing countries, the tax base is low and a large portion of people who should be in the tax net are not. The revenue administration is often weakened by lack of digitization, low capacity of tax officials and corruption.

Increasing government efficiency - Inefficient government spending and wastage are major fiscal issues in most developing countries. Developing countries also tend to have a larger public sector which adds to the fiscal burden. Some governments may have opportunities to rationalize their spending and reduce the number and size of government departments. A larger state sector means additional fiscal pressure which is offset by increased taxation, monetary financing or debt. Such changes are damaging to the economy. Privatization of commercially oriented state-owned enterprises is also a possible step for developing countries and can both raise revenue and lead to greater government spending efficiency.

In Africa, inefficiency in public spending leads to an average loss of more than 2.5% of GDP annually. Rigidities in wages and entitlements also play a major role. Inefficiency exists in social security spending where a large portion of social security payments go to administration costs which in some cases consumes almost 40% of the total budget. Transparency and digitization of procurement systems in developing countries can lead to a reduction in wastage and reduce corruption. But there may be institutional resistance to reducing waste and putting procurement on a more commercial basis. IMF research shows that improving governance in Africa can result in reducing inefficiency in government spending, helping recover up to 50% of their returns on investment in infrastructure. Greater government efficiency in expenditure will not only result in better fiscal positions but also help reduce debt levels and lead to greater economic output.

Greater economic growth - To improve economic growth and attract large-scale foreign investment, developing countries need to improve the ease of doing business and reduce red tape. Attracting investment also requires trade liberalization and trade facilitation as large multinational companies produce and trade in a globalized world. Governments also need to invest in education, health and infrastructure. Economic growth, especially through the growth of tradable sectors, will increase foreign exchange earnings, helping developing countries reduce their external debt levels.